You may be looking into ways to prevent identity theft, including credit monitoring. While you might have a credit monitoring account, shredding is the safest, most cost-effective and best identity theft protection that you could use. If your documents are shredded, no one will be able to get their greedy hands on your personal information. Once you start shredding your documents, you will have less use for credit monitoring, though it is still a good idea to have that, especially if you have never destroyed personal information before.

Since to theft protection service is able to prevent your information from being stolen, shredding is your best bet. Don’t forget, identity theft protection tells you once your identity has been used for something – it’s already happening when you learn of it. Shredding keeps people from getting your information in the first place.

Shredding is the Most Secure Option for Identity Theft Protection

Since shredding your confidential information is the most secure option for identity theft protection, is identity theft protection worth it? Yes, it is, because it does notify you if your identity has been stolen. Once you get used to destroying anything with any personal information on it, including receipts and mailing labels, your identity is less apt to be stolen.

Documents that should be shredded include:

-

Any piece of mail or document with your name on it.

-

Prescription bottles.

-

Digital media storage devices with any information on them.

-

Tax documents and supporting tax documents.

-

Any statements from banks, retirement accounts, stock accounts, credit card accounts, loans and other financial documents.

-

Old licenses, credit cards and store cards.

Shredding is More Effective and Less Expensive Than Identity Protection Providers

Identity protection services “guard” your personal information by alerting you to problems and potential problems. However, they don’t stop someone from stealing your identity. Only you can do that by protecting your information in the first place – making sure your personal information doesn’t get into a thief’s hands. The only way to do that is to shred everything with any identifying information on it.

In addition to having your documents professionally shredded, these steps will help you protect your identity:

-

Check your credit at all three major bureaus frequently. Pulling your own credit doesn’t lower your credit score.

-

Report any identity theft yourself at IdentityTheft.gov.

-

You can freeze your own credit files if needed.

If you have just an inkling that your identity may have been stolen, the first thing you should do is freeze your accounts.

What identity theft protection companies do

In a nutshell, identity theft protection companies monitor your information. If they see transactions that are not typical for you, they will alert you to those transactions. Monitoring services watch your credit files and will let you know when a new account is opened, when your score changes and when someone makes an inquiry using your social security number.

An alert is when the monitoring company notifies you that your information has been used. And some also provide recovery. If someone uses your information maliciously, the theft protection company will help you recover the lost/stolen money and will help you repair your credit.

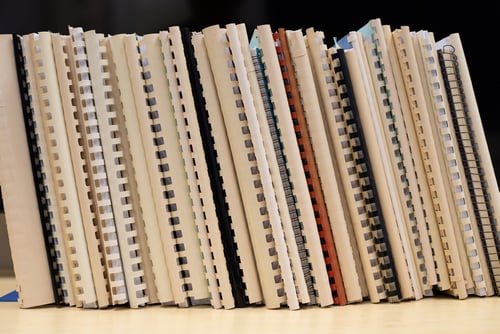

Contact Shred America

Contact Shred America to set up an account for shredding your documents. Whether you need us to come out frequently to shred business documents or you need us to shred once a year, we are able to accommodate you.

Carolina Shred's Back to Office Checklist

Carolina Shred's Back to Office Checklist

Document Disposal for Law Firms

Document Disposal for Law Firms

Comments