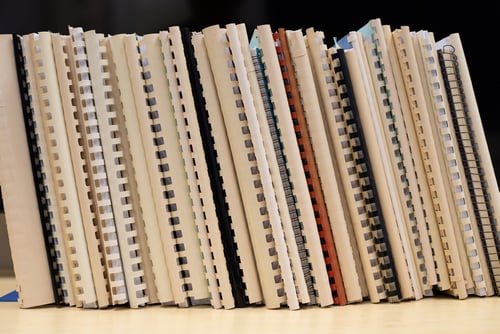

All of us have our own methodology when it comes to tax season. Some of us haul out a thick stack of documents and receipts, and then attempt to sift through it all. Some turn everything over to an accountant and hope for the best. But regardless of whether you itemize or not, your tax documents could be a gateway to identity theft if you're not careful. From stolen mail to dumpster dives, this is a popular season for criminals to go after you. In addition, you'll need to hang onto certain documents just in case you're audited at some point down the line. As you go through all the forms, we'll give you a better idea of what should (and should not) head straight to the shredder.

What Tax Records Do I Have to Keep?

You should be keeping all of your tax forms, schedules, and additional information to support your numbers. Your tax document checklist should also include bank statements and deduction-related receipts, so the IRS can see where your money is coming from and where it's going. Income-related statements may include 1099s, W2s, and 1040s, and these forms are especially important in an audit scenario. You need to prove that you've reported everything and that every cent is accounted for (or least relatively so). We also highly recommend keeping all of your property documents, loan records, and capital asset records. All of your major assets will need to be shown so the IRS can piece together a story should they decide to investigate.

Tax Record Retention Time

The IRS has the following to say about timing:

- The general rule is to keep all of your records for at least 4 years after filing the original return if your state has income tax and 3 years if it doesn't. Anything older should be scheduled for shredding services.

- If you're claiming a loss of worthless securities or a bad debt deduction, you should keep your records for 7 years after filing.

- If you're not filing a return for your income tax, you should keep records forever.

- If you're filing employment tax records, keep files for 4 years after the tax is either due or paid (whichever is later)

These timelines are tricky though because the IRS can after you forever if they suspect fraud or for 6 years if they believe you didn't report at least 25% of your income. As long as there are no major discrepancies though between your reported income and your lifestyle though, you should be fine to discard based on this schedule.

Contact Carolina Shred

Carolina Shred understands the importance of clearing out old documents. As all those forms and receipts mount, they're only going to become more overwhelming to tackle as time goes by. Too many people are concerned they'll throw the wrong thing away and end up keeping everything for decades later than they should. Don't let this happen to you when you call Carolina Shred. We provide shredding services that can help you prevent identity theft while simplifying your filing process. Once you've cleared out all the unnecessary forms, you'll only have to deal with one year of old documents by the next time tax season rolls around.

Carolina Shred's Back to Office Checklist

Carolina Shred's Back to Office Checklist

Document Disposal for Law Firms

Document Disposal for Law Firms

Comments