Before hauling all of the documents in, go through them and remove those you are not required to keep. You can have them shredded before hauling those heavy boxes into the office.

Carolina Shred Knowledge

Law firms need to keep most records for seven years, though they are required to keep certain documents for 10 years or forever. A probate attorney must keep wills and trusts for as long as the client is alive.

COVID-19 caused a lot of changes in offices and at home. Now that things are starting to get back to the new normal, having a plan in place for your return to the office should be a high priority. Decluttering all the paperwork from the past year, and getting ready to re-implement new data security protocols can be challenging, but it doesn’t have to be.

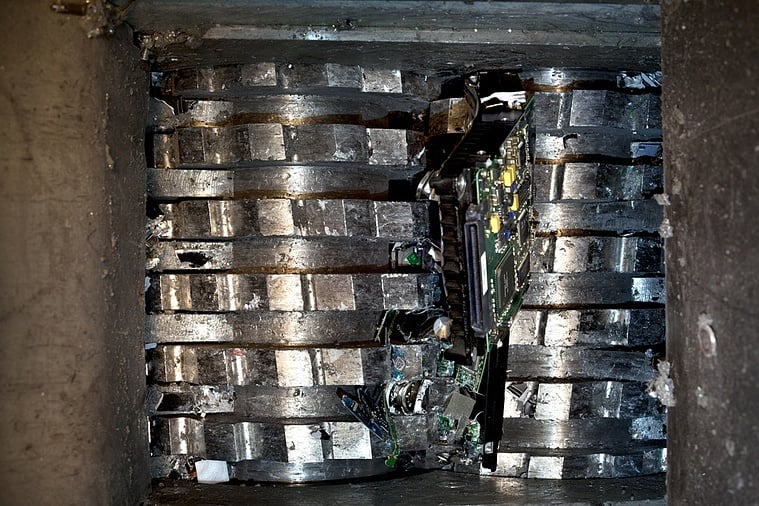

Just like people, technology goes through its cycles and gets old. Having the right computer recycling or technology disposal practices in place can save you a few headaches down the line. How many times have offices taken a hard drive program, think they wiped the computer clean and given it to another employee and all the old employee’s information was still there? The same can happen when attempting to wipe hard drives clean.

As a business, it is vitally important to protect your information. Any information collected or transferred from using a computer is in jeopardy. Upgrading your computer hardware from time to time is necessary. There are multiple ways people use to get rid of a hard drive, but that doesn’t mean they are doing enough to get rid of the information.

Tax records should always be shredded by a professional. Identity thieves are notorious for sifting through the trash and piecing together documents after shredding with an aftermarket device. Using professional shredding services can help prevent identity theft.

Technology gets old. When it’s time to get rid of those computers and software, where does it go? Most people don’t know what to do with old electronics or technology and keep it around for a long time. Businesses work with companies for electronics disposal or have the old technology sitting in a warehouse until they figure out what to do with it.

It’s tax time and the identity thief vultures are circling. One of the best things you can do is learn how to dispose of tax records. There are tons of shredding services that can ensure your identity is confidential and you won’t have to worry about your sensitive documents being compromised. Every year, companies and individuals are victims of tax fraud which makes it even more important to understand what needs to be done to keep your identities safe.

Your business is easier than ever, thanks to technology that allows you to digitalize documents and communicate via email and various live meeting platforms. You can save all that data to a hard drive and run a search on it when you need to find information. It’s much easier than keeping everything in paper files and having to read everything to find what you need.

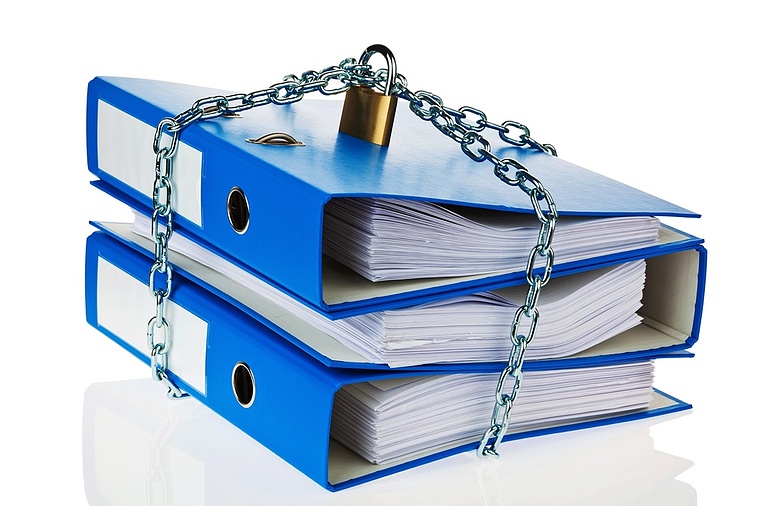

Many industries, including legal, medical and financial industries, are required to keep records for several years – sometimes as long as 10 years. In some cases, your business must keep certain records for over 10 years. These documents take up a lot of space in the office – and may not be completely secure.

If you associate tax season with identity theft season, you're right on the money. From online hacks to garbage sifting, this is the time of year when everyone's personal information is flying around in nearly every direction. The good news is that you can likely shred more documents than you think this year. If your bank keeps track of all your statements online, there's no need to keep years worth of paper in your file cabinets. When you shred your documents, you open the door to more space in your home and less proverbial clutter in your brain. Just the presence of unnecessary information can cause you to feel stressed, and that's before you even go through it all! We'll look at document destruction and how it can help you simplify your taxes.

All of us have our own methodology when it comes to tax season. Some of us haul out a thick stack of documents and receipts, and then attempt to sift through it all. Some turn everything over to an accountant and hope for the best. But regardless of whether you itemize or not, your tax documents could be a gateway to identity theft if you're not careful. From stolen mail to dumpster dives, this is a popular season for criminals to go after you. In addition, you'll need to hang onto certain documents just in case you're audited at some point down the line. As you go through all the forms, we'll give you a better idea of what should (and should not) head straight to the shredder.

Paper makes a lot of clutter – but everyone saves documents for many reasons, whether they are financial records, medical records or even monthly bills. Offices have even more clutter filling up filing cabinets. If you are a business, you need to clear out your files more often, but homeowners should go through their files at least once every six months to dispose of documents that you no longer need to keep.

Whether you are a business or an individual, identity protection is a major concern, especially now that most people have more than one device. However, though you might get many of your confidential documents via the internet, you still have plenty of paper documents. Virus protection, malware fighters, good firewalls, credit monitoring and other programs help to protect your online life. But what protects those physical documents that you have? The best way to keep people from stealing your identity by getting your paper documents is document destruction. This doesn’t mean just throwing them away or shredding them into strips. Thieves can put the strips back together. Instead, have your documents destroyed professionally by Carolina Shred’s cross-cut shredders.

Why do identity thieves want to get their hands on your hard drive? Old hard drives can provide a wealth of valuable information, including your Social Security number, banking details, and contact information for friends and relatives. Armed with this highly sensitive and personal data, identity thieves may attempt to open credit in your name, con people you know, or steal from your savings.

Organizations of every size and in every industry benefit from specialty document shredding services. Secure and timely shredding can help protect your organization’s proprietary information as well as the confidential information of your employees and clients, like their account numbers, addresses, and phone numbers. At the same time, failure to comply with retention guidelines – that is, shredding documents before it's time to shred them - can put your organization at risk.

When it’s time to upgrade your computer, or you’re forced to upgrade because of outdated technology, you will probably move all of the data on the current hard drive to the new hard drive. However, that doesn’t mean the data is gone, even if you erase it after you’ve transferred it. Any criminal could get the hard drive and steal the data off of it. Even if you “wipe” the drive, a hacker could recover some or all of your sensitive data. To adequately protect your private data, and that of your clients if you are upgrading a business computer, contact Carolina Shred about our hard drive destruction services.

Have you ever wondered whether your shredded documents are being compromised? As a business, protecting the sensitive information of your customers and your proprietary information is key. Having an onsite shredding solution can help alleviate any questions and provide peace of mind. Mobile shredding companies come to you. The company can leave a lock box to house the documents that need to be shredded, and then on shredding day, set up outside so you can have an employee monitor and confirm the documents have been shredded and disposed. How does this work? Mobile shredding trucks are outfitted with the latest technology to keep your records and sensitive documents confidential. Most trucks are locked while the documents are being shredded, but there is a screen on the outside where the employee can see what is happening in real time. From paper documents to hard drives and electronics, a professional firm handles it all.

Carolina Shred, the fastest growing shredding company in the Southeast, has named Dan Mayberry as a Territory Manager for the Upstate of SC and Western NC. His responsibilities will include overseeing Operations for the Western NC and Upstate SC area.

When it comes to getting rid of documents and other technology, many people opt to do it themselves without realizing how quickly they are compromising sensitive information. While it is always good to use a firm that specializes in hard drive destruction, it is much better to physically destroy your hard drive instead of using a data wiping program. It’s important to note that physically destroying the hard drive doesn’t mean dropping it on the floor and thinking you’ve damaged it enough to harm the data on it. It takes much more than that.

Think about the last time your laptop or desktop computer bit the dust. Chances are you relegated it to the electronic waste facility (or sold for a few bucks on Craigslist) without a second thought.

Most offices have a records retention schedule that determines how long the office has to keep client or patient records. At the end of the retention time, the office may shred the files if the clients or patients do not want them. Personnel should use proper procedures for document destruction of those documents and files that have an expired retention time. For example, the law requires many law offices to retain client files for at least seven years. At the end of seven years, the office may destroy the files if the client does not want them.

Medical businesses and some other businesses are required to keep records for a certain period of time pursuant to HIPPA regulations. Additionally, when it’s time to get rid of those records, these businesses must dispose of medical documents and other personal or confidential documents in such a manner so that no person may recover the documents. While North Carolina has no state law dictating how long a business must keep client or patient files, federal laws and regulations do.

Many businesses have confidential files that must be destroyed daily as those files reach the end of their retention schedule. Shredding these documents with a small office shredder not only takes up employee time but if the shredder is not a cross-cut shredder, it is possible for someone to recreate the documents. Carolina Shred provides locked shredding bins and on site shredding for businesses so that office personnel may dispose of old documents in a safe manner with less cost. Business shredding with Carolina Shred also saves a business money.

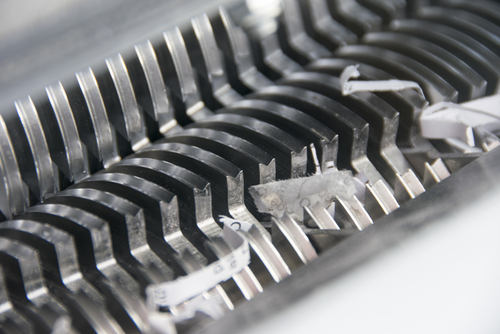

Different types of shredders cut paper into different sized pieces. Shredders that produce the smallest pieces provide the highest level of security but also cost more. When you choose a paper shredding service provider, consider how much security you need. Large companies need more sophisticated shredders to provide the most protection, while small businesses and people shredding their household papers are often able to use simpler machines.

DIN standards have seven levels, which indicate the size of the paper particle once it goes through the shredder. The levels start at P-1 and go through P-7. If you need high security for your shredded documents, you need a shredder that uses a higher number. P-7 is the most secure as it’s the smallest paper particle. While the DIN standard is rather complicated, part of it is paper shredder security levels, which simply tell you the size of the paper once shredded. Thus, a shredder that cuts at level P-5 is more secure than a shredder that cuts at level P-2.

The GDPR is the EU General Data Protection Regulation. It replaces the Data Protection Directive 95/46/EC. The GDPR definition is a process that applies to personal data processing by processors and controller in the EU. It also applies to personal data processing by a processor or controller that is not established in the EU if the processor or controller offers goods and/or services to EU citizens.

You may be looking into ways to prevent identity theft, including credit monitoring. While you might have a credit monitoring account, shredding is the safest, most cost-effective and best identity theft protection that you could use. If your documents are shredded, no one will be able to get their greedy hands on your personal information. Once you start shredding your documents, you will have less use for credit monitoring, though it is still a good idea to have that, especially if you have never destroyed personal information before.

People throw junk mail and other papers away without thinking twice about what information could be gleaned from those documents. Your address is a big piece of the puzzle when someone is trying to steal your identity. As part of identity theft prevention, you should shred any piece of paper with your address, phone number or other identifying information on it.

Document shredding is the best way to get rid of any document with personal information, but can paper shredding be eco-friendly? Yes. In fact, it is better for the environment to shred documents you no longer need. The trucks that come out to your business or home are very efficient on gas mileage, plus the collection console use low-emissions materials.

Mobile shredding has many benefits and the most important benefit is that it is nearly impossible for someone to reconstruct a document. With home shredders or those found in small offices, the paper is shredded into strips, which takes a little patience and time to reconstruct. Crosscut shredders create piles of tiny pieces. Those pieces are mixed with others’ documents and then baled before sending to a recycling company.

Confidential information and trade secrets are often the targets of identity thieves and disgruntled employees. The Trademarks Act, Copyright Act and Patent Act do not regulate many trade secrets or any confidential information. This means that you have to protect this information yourself. Security compliance should be taught at your place of employment or your business if you are a business owner.

In 2017, a security breach at Equifax caused over 145 million Americans to have their personal information accessed. And that doesn’t count the millions who were harmed or potentially harmed by security breaches at JP Morgan Chase, Target and Uber. You may do everything you can to keep your confidential information out of the hands of identity thieves, but there’s not much you can do if they access it through a company you trust to keep your information safe.

Knowing which documents you need to do your taxes and having them at your fingertips makes doing your taxes much easier. You will be able to do your taxes all in one shot instead of stopping for hours or days to get back to them. And, if you have an accountant do the taxes, the accountant won’t be delayed by having to call you for additional documents. Documents you need for include:

Any firm, whether medical, law, accounting or other industry that deals with client records, should use shredding services. These types of firms must keep client records for a specific amount of time, after which, if the client doesn’t want his or her file, the file may be disposed of. However, you can’t just dump the file in the landfill.

Accounting firms, like many other firms, must get rid of old files responsibly. Because of the nature of the information contained in an accounting firm’s files, the files cannot be thrown in the trash – they must be destroyed so that they cannot be put back together.

Over 17 million Americans fall victim to identity theft every year. Every day, you hear about some high-profile corporation having security breaches or a scenario that could lead to an identity theft nightmare. If major department stores, large corporations, political parties and even the USPS can be hacked, you can be hacked too. Protect yourself and protect your business from identity theft by taking certain actions to protect your personal information or to protect company data from identity thieves.

Protecting confidential information in the office is one of the most important functions a business does. If confidential information gets out to the public by any means, the business could be subject to fines. When a business hires new employees, part of the orientation should include procedures to protect confidential information. Your business should also hold "reminder" meetings regarding protecting documents.

If confidential business information gets into the wrong hands, a business could fail. Or, it could suffer at the hands of criminals. Keeping business, employee and management information under lock and key and only available to those who need to know the information is just one of the ways to prevent your data from falling into the wrong hands. Learn how to keep these 5 examples of confidential information in the office away from the wrong people.

Law firms must keep client documents for a set number of years depending on the type of file. Some documents, such as wills, trusts and other estate planning documents should be kept for at least the lifetime of the client. However, if all files were kept forever, it would become a financial burden because of the space those files take. After the requisite number of years have passed, those files may be destroyed after notifying the client.

Most offices have several types of confidential information. You may think that just because you aren’t a large company that employee and customer confidentiality isn’t a major issue. However, no matter the size of your company, you do have confidential information and security risks. Learn how to keep information confidential so that you aren’t liable for fines or lawsuits from employees and customers should their information get into the wrong hands.

Law firms are notorious for accumulating box after box of sensitive case files and other confidential information. Attorneys are held to high standards when it comes to protecting client information.

Files must be kept for a certain period of time after the case closes, and some files may not be destroyed. RPC 209 requires that attorneys keep documents for a minimum of six years after a case closes before document shredding can occur.

However, items such as estate documents, real estate documents and some financial documents should be kept forever. An attorney may destroy a file prior to the six-year minimum, but he or she must have permission from the client. Since files are the client’s property, the attorney also has the option of giving the file to the client.

Shredding important documents – documents with any personal information, even an address – is one of the most important things you can do whether you are a business or an individual. Most people and businesses realize that shredding documents that no longer need to be kept is important, but some do not realize just how important it is. The top 5 reasons to shred documents includes identity theft and protection of customer data.

Many may wonder, “Why is confidentiality in the workplace so important?” Some information is obvious, such as employee or client social security numbers and financial information. Other information, such as certain business information and management information may not be so obvious. However, trade secrets and other information are usually highly confidential. Training employees as to what constitutes confidential business information goes a long way in protecting your business.

Definition: Document Shredding

document shredding defined in under 100 words

Document shredding is the act of destroying paper documents by inserting them into a home, office, commercial, or mobile shredding device. Document shredding services can help prevent identity thieves from obtaining sensitive information and exposing your clients, employees, and vendors information to financial conflicts.

Types of documents that should be shredded include:

- Medical Records

- Tax Returns

- Employee Information

- Credit Cards

- Banking Accounts

One your entire organization learns how to handle confidential documents in the office, your trade secrets, employee information and customer information will be much safer. Part of handling confidential information best practices guidelines is knowing what documents are confidential. In addition to the physical handling and access of paper and digital information, employees should sign non-disclosure agreements (“NDA”). In some cases, you may need third parties who work with your company to sign NDAs.

Most workplaces have a confidential information clause written into their employment agreements. Whether you work for an attorney, real estate agent, doctor, or even in a factory, you may have access to confidential information. Confidential information is anything that has sensitive information containing personal data. This type of information must be closely guarded so that it doesn't get into the hands of a competitor.

When it's time for a new computer, you need to take some steps to ensure that the data from the old hard drive isn't accessible. Even if you “wiped” the drive, some of your private data, such as passwords and bank account information, may still be accessible. The only way to ensure that someone isn't able to retrieve your private information is by ensuring that the hard drive is completely destroyed so that data is not retrievable.

Shredding documents is an important step in securing your personal data or, if you own a business, your customers' personal data. Shredding hard drives is also a step in protecting personal and confidential data, though most people do not think about shredding hard drives – they just throw the computer away.

When choosing an onsite shredding company, you should find out several pieces of information. Carolina Shred provides all of the information you need to know to choose an on site document shredding service, including information about shredding services and reasonable prices. After you ask yourself how to choose an onsite shredding company, visit our website to find the answers to your questions.

Mobile shredding trucks come out to your home or business to shred sensitive documents. You could either set up a schedule for us to come out or have us purge documents. If you are a business that has a lot of confidential information to discard, we provide locked boxes for you to deposit your documents into. As the boxes are filled, we come out and shred the contents. You might have us on a weekly, bi-weekly or monthly schedule. If you are purging, you might be a resident or a business that has documents that were saved for a recommended time that you need to get rid of.

If you have tons of documents to shred, whether you are a business or a residential customer, you need to dispose of those documents in a safe, secure, and environmental friendly way. Destroying old documents helps mitigate stolen information that unscrupulous people may use to steal your identity and benefit off you. For businesses owners, this is very important as you are legally required to keep your customers' information safe and out of the hands of criminals.

Most companies have switched to digital data instead of keeping paper files. Doctors, lawyers, banks and many other professions now store files on the computer. Eventually, a computer becomes obsolete or it dies and companies replace the computers with new computers. Even if you format the hard drives on the computers being thrown away, data thieves could still get information that was stored on the hard drives.

When you shred documents yourself, someone with a lot of patience is still able to piece together the documents to gather private information about you or your clients and customers. Mobile shredding trucks cross-cut shredders that make it nearly impossible to piece together documents, plus the shredded documents are bagged and recycled. Instead of taking a chance of becoming an identity theft victim because of stolen documents, find a mobile shredding company near me to shred your documents and old digital media. Carolina Shred offers mobile onsite shredding services for businesses in the Charlotte NC and surrounding areas.

A free shredding event raised over $2,000 for Tega Cay Camp cadets. The shredding event was held at the Tega Cay Police Department and Carolina Shred provided the shredding trucks. American Burger Co. served burgers. Over 100 local residents brought personal documents to be shredded and over 350 local residents attended the event.

Professional shredding services ensure that your documents are cross-cut shred with no possibility of putting them back together to steal confidential information. Carolina Shred has lock boxes that we leave on your premises to hold documents that need to be shredded. The documents stay locked until they are ready for the shredder. Shredding service cost is reasonable and a good insurance policy against identity theft.

No business, regardless of size, is immune to cybercriminals. Even well-known companies such as Home Depot, Target and TJ Maxx have been targeted by hackers. In today's technological environment, you have to stay on top of all types of threats to data security and integrity, right from your hardware through your employees. Never assume that your business is too small for cybercriminals to target.

The risks and threats of company data being purposely stolen or inadvertently “shared” are high unless you have excellent security measures in place. Some of the challenges businesses have in securing data may easily be overcome with a good security plan put in place, including locked boxes for documents that need to be shredded.

Over 78 percent of business and organizations have had their data breached in 2010 and 2011, according to a Ponemon Institute Study. Even with the advent of new security programs over the last year or two, companies still continue suffering data breaches. Insiders, negligent employees and hackers may all pose threats to data security and integrity.

Now that many companies have an online presence, especially payment gateways online, data breaches are imminent. As software companies come up with software to stop, hackers and spammers find more ways around getting through the information. Keeping your data protected takes a major part of a company's resources. To prepare for data breach, you should take steps to beef up your digital security while at the same time, ensuring that non-digital information is also safe, a knowing the risks and threats of company data.

Carolina Shred offers mobile shredding services for businesses and residential shredding services in Charlotte NC and surrounding area. Many businesses may not want to send their documents to a shredding service and instead, opt to watch their sensitive documents get shredded. Mobile shredding is perfect for this since customers may watch documents go from the document storage containers directly into the shredder. Carolina Shred is part of the Mobile Shredding Association and it MSA certified.

This holiday season practice safe Christmas shopping if you shop online. Deloitte estimates that over one trillion dollars will be spent by Americans in just online shopping this year. And, Nasdaq stated that fraud rates go up more than 200 percent during the Christmas shopping season. Protect yourself by knowing how to spot fraudulent sites among other actions this year.

Information security compliance laws are not just for your IT department. If everyone is aware of the regulations, your company is more secure since information does not leave a secure area by mistake. When your employees know the regulations, you'll also save money because some regulations come with hefty fines if they are broken.

Everyone who works for a living expects to be safe at work. In fact, the OSHA General Duty Clause 29 U.S.C. §654, 5(a)1 states, “Employers are required to provide their employees with a place of employment that “is free from recognizable hazards that are causing or likely to cause death or serious harm to employees.”” Additionally, employees expect their personal information to be kept safe. Workplaces have sensitive information including social security numbers, birth dates and addresses.

Maybe you rip documents into teeny tiny pieces before tossing them into the trash. Perhaps you cut old credit cards with scissors prior to discarding them. Maybe you go a step further and toss these pieces into separate garbage bags to make them less likely to be put back together in a sinister jigsaw puzzle entertaining an identity theft. If you already take these steps to protect personal information, then you might as well learn about document shredders, the difference between a commercial shredder and a standard home shredder, and what steps you should be taking to safeguard your sensitive information or your customers' information if your company has yet to establish a document discard policy.

Shredding documents help keep your identity from being stolen. Even things that seem innocent, such as prescription labels, could help someone steel your identity. Even though things like your address and phone number might be public record, identity thieves could pair this easy-gotten information with other information to make stealing identities easier. They may even use relatives' names to locate your social media pages.

Certain documents must be kept as paper copies and as digital copies. However, keeping important paper documents in your home could lead to identity theft, or something could happen to them, even if you keep them in what you think is a safe place. They could be stolen if someone breaks in, they could go up in flames if you have a fire, or if your home gets flooded, they could be ruined in a flood. A tornado could spread your important documents all over the county.

Shredders are inundated with shredding industry legislation to keep your information safe. Several laws exist to help keep your personal information safe from identity thieves. Shredding companies like Carolina Shred must abide by these laws, whether you are a business or an individual that uses the company to destroy personal records, whether paper or electronic.

If you are one of the few companies that still uses paper documents or keeps paper documents, the information contained in them may be at risk. Keeping paper documents without the proper security allows anyone to raid recycling bins or trash cans. And, if employees leave confidential information on their desks, anyone could walk by and take the documents or copy the information.

When it's time to get rid of an old computer, whether you are a business or an individual, you need to take steps to secure the hard drive – and that means ensuring it's completely destroyed so that less than honest people are not able to get your personal or work information from the drive. Also, check out our guide to shredding medical documents for more information about medical document destruction.

Hackers cost the medical industry over $6 billion per year, and that number is steadily growing, according to an IT security researcher, the Ponemon Institute. Because the protections are lax at physicians' practices and at hospitals, they are easy targets. And, combined with that, with one person's medical record commanding up to $1,000 on the darknet, this industry is a ripe target. Compare this to $0.25 for a credit card number and $0.10 for a social security number.

Certain businesses, including medical businesses, are subject to HIPPA regulations. This means that records must be kept secure for a certain amount of time, and they must be disposed of properly when it's time to get rid of them. For medical facilities, there may be several different rules, rather than one set rule that states you must keep documents for a certain number of years.

Before hiring a shredding company, many businesses, particularly those who deal with secure documents, have common questions about document shredding. Carolina Shred handles all documents with the utmost care, ensuring that any confidential information stays confidential and that your documents and other items that require shredding are secure.

Now that your taxes are done – hopefully – you may get rid of some of that paper that is taking up space in your filing cabinet. But, you don't get to throw all of it out, not just yet. What you can throw out should be shredded by a shredding company such as Carolina Shred.

The why recycle shredded paper question is easily answered. It’s to safeguard confidential documents and maintain privacy. But, when it comes time to recycle that shredded paper, there are some problems that you need to be aware of. When paper is shredded, the lengths of the individual paper fibers are cut. This can reduce the recycling potential of that fiber. Also, when mixed paper from businesses and households are shredded, that paper gets grabbed by automated screens that get pulled into the reject bin and go off to the landfill. Shredded paper is also difficult to sort from other recyclables. So, why should you recycle that shredded paper?

When you notice transactions on your bank account or credit card that you know you didn't make, your heart sinks, knowing that your information was somehow compromised. The first thought through your head is, “My identity was stolen, this needs to get fixed.” However, several steps must be taken to repair the damage, and it may seem overwhelming at first. So that you don't miss anything, make a list of what to do if your identity is stolen. So how do you prevent identity theft and what steps to take if your identity is stolen.

Though taxes aren't due until mid-April, many people do their taxes early. The first quarter of the new year is a haven for identity thieves because people do not think of shredding old tax documents or copies of documents that have personal information on them, including your social security number. Reduce your chances of becoming an identity theft victim by properly shredding important documents, including tax documents.

Do you just toss most junk mail and other documents that become useless in the trash? You could be setting yourself up for identity theft if you do. Certain documents should be kept forever, some should be kept for a number of years, and some could be thrown away immediately. However, you should take note of what kind of information is contained in those documents before you chuck them.

In this digital age, worrying about how to send your tax documents securely is always a concern. There’s lots of sensitive information on tax documents, such as social security numbers, banking information and addresses. Here’s a list of options on How to Safely Send Your Tax Documents in 2017.

You may think that keeping important documents in a lock filing cabinet is enough security, but with today's technology, electronically storing documents is much safer. You can assign levels of confidentiality and assign employees levels of confidentiality for access. Furthermore, when it's time to purge files, you don't have to worry about choosing a shredding company that you trust. A side benefit is that you have extra space that is no longer taken up by filing cabinets.

Information is power. However, that information can damage your company’s privacy and even the business itself. It can also lead to security breaches and identity theft. And when it comes to document destruction, there are federal and state laws on how to properly dispose of data. The risks that documents fall under include:

As a business, it’s important to destroy documents according to a retention schedule. There are specific regulations and rules that need to be followed in order to stay on the right side of the law. And keeping some documents for longer than needed can cause as many problems as not keeping those documents long enough.

Canada has apparently accumulated too much paper.

The federal government spent approximately $12 million more on hiring companies that offer services like document shredding and storage in the last fiscal year than it did ten years ago, according to an analysis of Public Accounts documents.

According to the SBA, Small Businesses employ about half of the nation’s private workforce.

At some point, you will need to get rid of important documents and papers that contain sensitive information like:

- Client information

- Employee records

- Medical records

- Tax records

- Credit card statements

Stacking them in a corner of your home office, or under your bed, only works for so long. Eventually you will need to toss out those old tax returns, pay stubs, receipts and other once-important papers.

.jpg)